CIO REIT (Position Closed Feb 10, 2025)

- Emerald Shores Investor

- Jan 30, 2023

- 6 min read

Updated: Feb 17, 2025

Update to report: Today is Feb 10, 2025

I have personally closed both the real estate positions in my portfolio. This was done as of Feb 10, 2025. Both were at a loss. My understanding of this space is quite frankly below par. Im glad I was humble enough to admit such things. Sometimes it can be difficult letting go of an idea you spent a time on but you must look at opportunity costs in such decisions.

I have since closed the positions and increased my allocation Chinese Companies recently. I recently bought 2 companies over there. I think these choices I made have been for the better in terms of potentail for long term cash flow production and growth opportunities. More importantly I think i got a lot more value per dollar by allocating more capital there. Time will tell.

Disclaimer

A position in CIO was initiated today, Jan 30, 2023. It is 5-6% of total portfolio. Investments do have risk and the valuations presented here may not come to fruition and also cause loss of principal.

Business Description

CIO is an office REIT with high quality properties mainly composing their Real Estate portfolio. Majority of them Class A tier quality.

Their locations include Portland, Seattle, San Diego, Dallas, Orlando, Tampa, Raleigh, Denver, and Phoenix. They are positioned in cities that have had faster growing populations over the past decade.

Investment Thesis

CIO Intrinsic value is at least $16.90 per share based on Properties only.

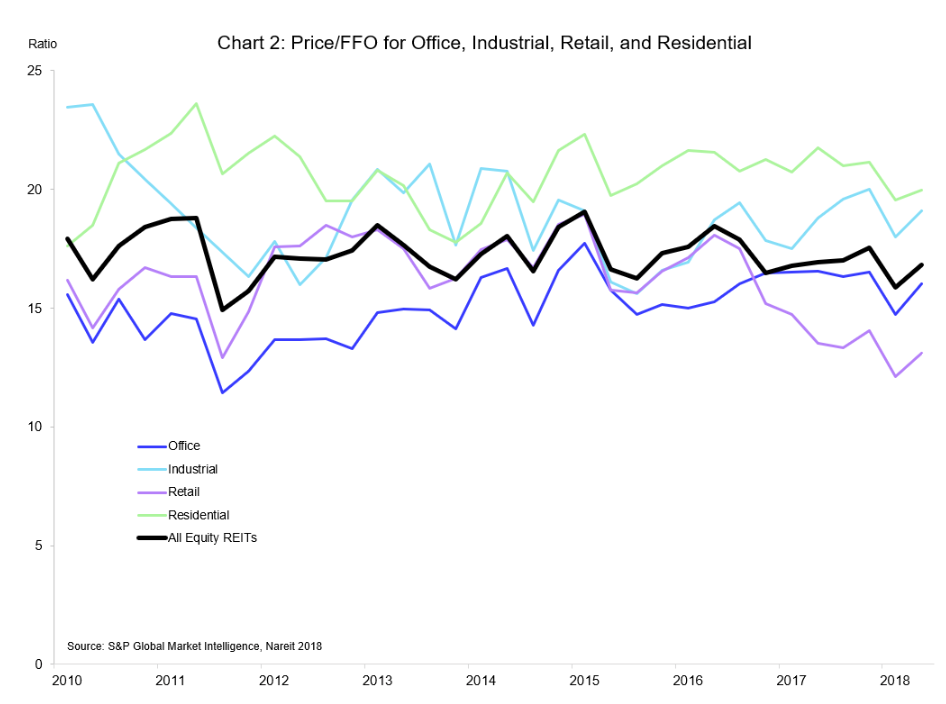

If we use traditional metrics like p/ffo of 6x currently they are on the lower end of REIT Office historical average @ 14-15x. For this analysis I chose to use a situation where liquidation may become the outcome due to leases that are coming due and the debts coming due in the next 3-5 years. Do note, I don't think liquidation will be the case by any means but the market wants to price the business as such and of the quality of the assets listed I don't think the current valuation makes sense at all. Once we get past the current bump in valuation I think more traditional metrics like average P/FFO will be a useful gauge.

Source: REIT.COM https://www.reit.com/news/blog/market-commentary/looking-between-the-sectors-reit-price-multiple-performance

That said, CIO is currently priced at .54 cents on the dollar. Empirically this business has traded at a pb of 1-2. To reiterate, the business is currently priced this way because Mr. Market may see upcoming maturities on the debts in the next 3-5 years and has doubts on the assets values overall in relation to those debts. This as well as an assumption of the onset of WFH have spurred investors out of the asset. Thus he has discounted the price to create an opportunity for the bargain hunters willing to do a little homework.

My counter argument is that Mr. Market is wrong on the basis for pricing the assets at such a discount. These higher quality assets for office space have staying power and I believe that the market has priced in WFH all too soon and is negligent of a middle ground in thinking at the current valuation.

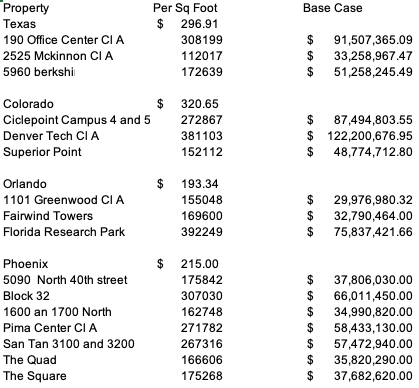

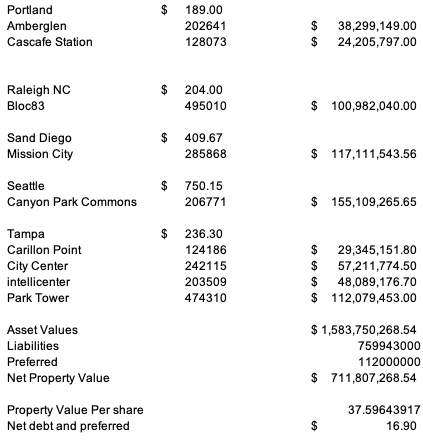

Valuation:

With that said, I utilized a liquidation value approach for the security as opposed to calculations of P/FFO. Note, they are also on the lower end of their p/ffo per 2022 Q3 guidance. This makes the p/ffo around 6x where, once again, average p/ffo for office REITs have been around 14-15x.

Why liquidation value? Sounding like a broken record here although I want to get these points across. Even if leases aren't renewed in a timely manner and or they cant refinance debts, near term, I want to get some sort of margin of safety in their Asset Value. Based on what Ive research Mr. Market is really Mis-pricing these properties. I believe the assets are currently being valued slightly above a worst case scenario.

By going through each asset and valuing them on an average square foot sale price in each city my findings came to the assets being valued as of 2021 more along the lines of $1.583 billion just for the assets alone. If I subtract the liabilities that comes to a liquidation value of 16.90 per share. This value is taken from the property liquidations alone.

Base case:

The per square foot values used were a more broad estimate as well. I used estimates from commercialcafe.com which was used a population of recent sales for the year 2021. Given a lot of these properties are Class A in nature I believe they could actually be sold at a premium to the value I used as well. The estimates I used are more of a base case value.

Best Case:

Best case scenario would be if we use CIO recent sale data. Their recent sales have all been at least 2x property value on the books since COVID.I believe this is attributed to the quality of the assets they have on hand. Also historically they have been at least able to sell assets at or around par.

Below are a few data sets from recent 10ks that can show case evidence of potential higher values for assets sold.

Information set 1: 2021 10K page 44 and 45

Sale of Real Estate Property

On February 10, 2021, the Company sold the Cherry Creek property in Denver, Colorado for a gross sales price of $95.0 million, resulting in an aggregate gain of $47.4 million net of disposal-related costs, which has been classified as net gain on sale of real estate property in the consolidated statements of operations.

On December 2, 2021, the Company sold the Sorrento Mesa portfolio in San Diego, California for a gross sales price of $576.0 million, resulting in an aggregate gain of $429.3 million net of disposal-related costs, which has been classified as a net gain on sale of real estate property in the consolidated statements of operations.

Information set 2: 2020 10k page 75

Sale of Real Estate Property

On July 23, 2020, the Company sold a land parcel at the Circle Point property in Denver, Colorado for $6.5 million, resulting in an aggregate gain of $1.3 million net of disposal-related costs, which has been classified as net gain on sale of real estate property in the consolidated statements of operations.

On December 12, 2019, the Company sold the Logan Tower property in Denver, Colorado for $12.6 million, resulting in an aggregate gain of $2.9 million net of disposal-related costs, which has been classified as net gain on sale of real estate property in the consolidated statements of operations.

On May 7, 2019, the Company sold the 10455 Pacific Center building of the Sorrento Mesa property in San Diego, California for $16.5 million, resulting in an aggregate gain of $0.5 million net of disposal-related costs, which has been classified as net gain on sale of real estate property in the consolidated statements of operations.

75

On February 7, 2019, the Company sold the Plaza 25 property in Denver, Colorado for $17.9 million. No gain or loss was recognized on the sale as the property was carried at fair value less cost to sell on the date of disposition.

On March 8, 2018, the Company sold the Washington Group Plaza property in Boise, Idaho for

$86.5 million, resulting in an aggregate net gain of $47.0 million, net of $1.7 million in costs, which has been classified as net gain on sale of real estate property in the consolidated statements of operations.

Conclusion:

CIO is pretty undervalued at the current valuation. Recent sales and more broader values used indicate that Mr Market may have it wrong currently. On top of that any acquirer of the asset will get a nice yield attached to the assets as well. If they do sell assets the dividend may not be sustainable but that is not the base case here rather I would take any dividend at the current valuation as a sweetener/ additional value add.

Once Mr. Market realizes the above at least as a base case level and all the uncertainty is gone I think other measures of P/FFO multiples will then make sense to use for valuation reference.

Catalysts:

Asset Sales. This would be a large driver in value fruition. If they sold assets that were selling at a large premium.

Refinancing

Lease Renewals

Comments