Long-Term Value SWKS

- Emerald Shores Investor

- Jan 12, 2023

- 2 min read

Updated: Oct 19, 2023

Disclaimer: Please note the business, Skyworks Solutions inc., represents 8-10% of the portfolio. The information provided here is not intended as financial advice and should not be relied upon for investment decisions. There is a possibility of loss of principal and the valuations presented are not guaranteed to come to fruition.

Business Description: Skyworks is a semiconductor company that specializes in mixed signal and analog chips for various industries, including aerospace, automotive, 5G infrastructure, smart homes, and more. They have a competitive advantage in the market due to strategic acquisitions, investment in research and development, and partnerships with manufacturers. With the technological evolution of IoT and 5G, Skyworks is well positioned for long-term growth.

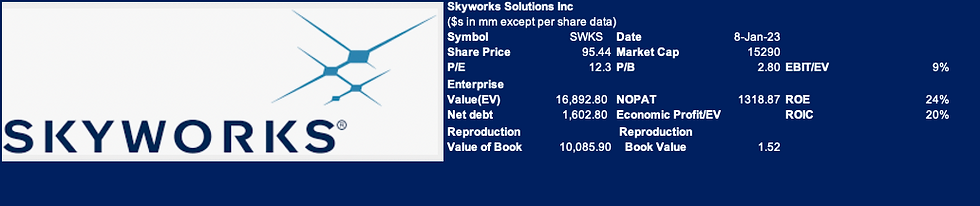

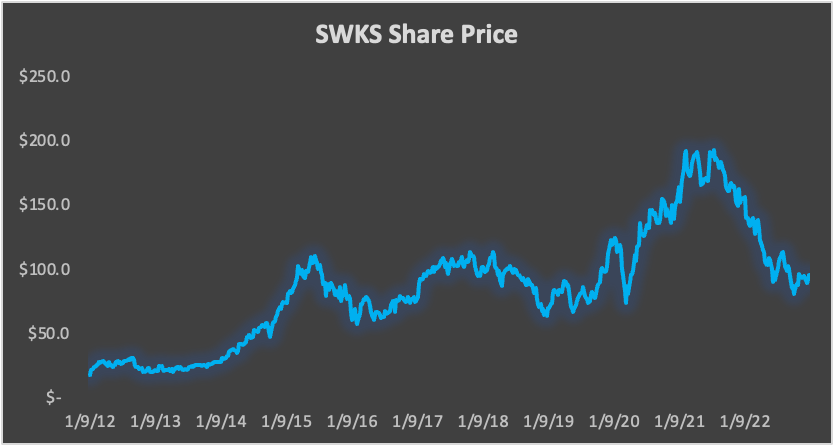

Investment Thesis: Despite the recent tech sector pullback and slowdown in the semiconductor industry, SWKS is currently priced at a no growth level, presenting a great opportunity to purchase a solid company at a fair price. With their strong competitive position and ongoing investments in growth, Skyworks is well positioned for an industry turnaround over the next few years. The long-term potential for growth in the IoT and 5G markets could lead to a richer valuation for the company in the future.

To achieve a higher valuation, there are several factors that contribute to SWKS's success:

I. Business factors: SWKS has maintained a solid capital structure over the past decade with operators allocating capital efficiently. They have had robust cash flows and consistently reinvested these funds intelligently to grow the business through acquisitions and R&D. Additionally, they have rewarded shareholders through dividend and buybacks. These factors show that the management team can strike a balance of innovation and profitability, resulting in economic profits.

II. Return Factor: SWKS's consistent and persistent high returns on equity and invested capital indicate intelligent reinvestment of capital and management's ability to run a business well. These elements are strong indicators of continued market returns for shareholders.

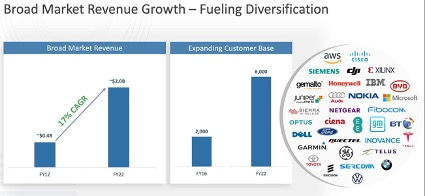

III. Tech/Brand Value and Recent Acquisition: SWKS's brand recognition has increased with a 200% customer base increase from 2016 to 2022. Additionally, their ability to work closely with their customers and deliver high-quality products has led to partnerships with major companies like Apple. SWKS has also made significant acquisitions, such as the purchase of a business segment from SLAB in 2021, which has opened the doors to home and automotive more significantly than the prior decade. This acquisition will help them reach a better level of production, which could bring back Apple's share of the revenue pie, and diversify their revenue base in line with the everchanging EV and auto industry.

2022 Skyworks presentation

IV. Systematic/Industry-Specific Cyclicality: The semiconductor industry has slowed down, presenting opportunities where a solid business can be bought where growth isn't priced in currently. Despite this backdrop, SWKS has had revenue growth of 7% for the year, indicating their ability to adjust to the changing dynamics of the industry.

Valuation: Based on the factors mentioned above, there is potential annualized return range of 14-20% over the next 5 years. My target price for SWKS is $196 per share.

Comments